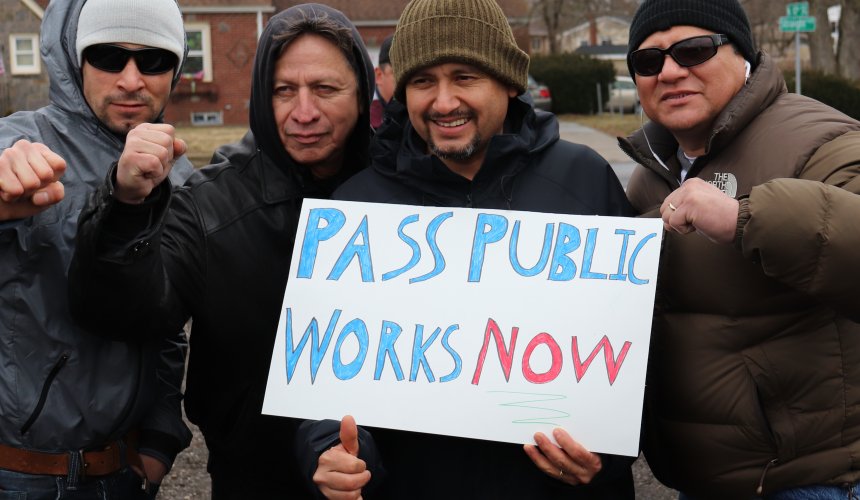

Prevailing Wage Win in New Hampshire

The House of Representatives voted 213-140 yesterday to pass SB 271, which would require prevailing wages on state-funded public works projects.

“All workers employed by or on behalf of any contractor, subcontractor, or hiring agent engaged in the construction of public works for the state of New Hampshire or any agency, officer, board, commission, or authorized agent of the state shall be paid a wage of not less than the minimum prevailing hourly rate of wages and benefits for work of a similar character in the county in which the work is performed.”

This new law would ensure that workers are paid fairly for the work they are doing and mandates payroll requirements to ensure that workers are being paid properly. Along with ensuring proper payments to workers the bill provides protections for the state agencies to withhold payment for contractors who fail to meet the prevailing wage requirement and bars them from future contracts.

Representative Brian Sullivan (D-Grantham), Chair of the House Labor Committee, released the following statement:

“Reestablishing a prevailing wage law in New Hampshire will ensure that construction workers receive fair wages on jobs funded by New Hampshire tax dollars. Prevailing wage standards assure that state construction projects are awarded to contractors that produce efficient, high quality work, and help keep local tax dollars in the state, going to local workers and local companies. It is past time that New Hampshire joins its New England neighbors in enacting this common sense policy, which assures competitive wages are paid on taxpayer-funded projects.”

Senator Feltes (D-Concord), the prime sponsor of SB 271, released the following statement after the vote:

“Prevailing wage laws ensure that construction workers receive fair wages and help keep New Hampshire taxpayer dollars going to local workers and local companies. It’s great to see the Senate take the first step to make tax dollars work for New Hampshire working families by joining our New England neighbors to enact this common sense policy.”

Additional key points in this new prevailing wage law include:

Posting of Wage Scale at Worksite

“A prime contractor awarded a contract for a public works construction project under this chapter shall post the prevailing wage rate scale for that project in an accessible and prominent location at the worksite where it may be freely seen and inspected by all workers employed on the project site, for the life of the contract.”

Three Year Ban For Non-Compliance

“Any contractor or subcontractor determined by the department to have violated the provisions of this chapter shall be ineligible to bid on or be awarded any public works contract or perform any construction work for or with the state of New Hampshire or a state agency for a period of 3 years from the date of the final administrative determination.”

State or Public Works Department Can Withhold Contract Payment If Prevailing Wages Are Not Paid Properly

“A portion of stipulated contract payments may be withheld from the contractor as considered necessary by the department or authorizing agency for the purpose of compensating workers hired to perform work on a public works construction project under this chapter when such workers were paid less than the minimum prevailing wage stipulated in the contract.”

Contractors Can Be Fined Up To $2,500 Per Day For Failing To Keep Payroll Records Or Submits False Records

“Any contractor, subcontractor, hiring agent, or its designated representative who is under contract with the state of New Hampshire or its authorized agent for the execution of a public works construction project under this chapter, who neglects to keep and submit accurate certified payroll records under RSA 280-A:8, or refuses to allow access to the records at any reasonable hour to a person authorized to inspect such records, or knowingly submits false payroll information to the agency administering the execution of the contract shall be subjected to a civil penalty of not less than $250 and not more than $2,500 per violation. Each day the violation continues shall, with respect to each employee, constitute a separate offense.”